Designing a choice: Behavioural change interventions

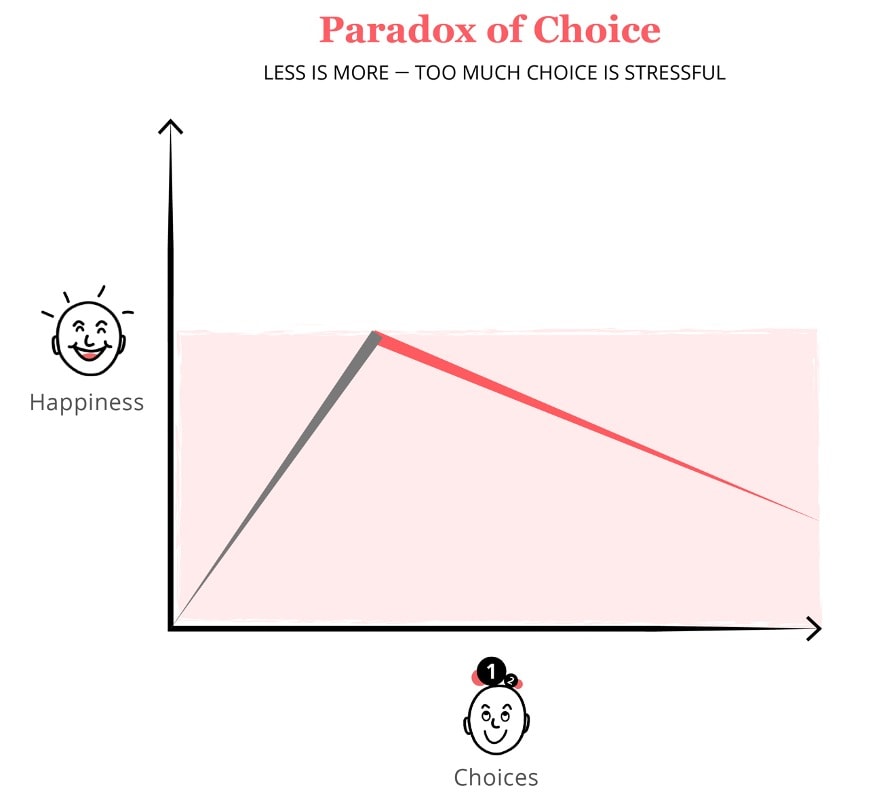

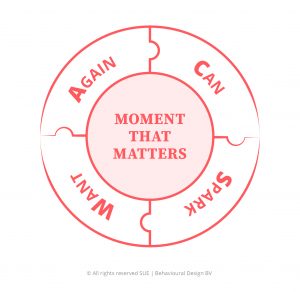

Time to turn human understanding into practice. What can we do to help people make better decisions and be more satisfied? I want to show you five behavioural intervention strategies to design for better choices:

Limit or remove options

Terminate products or services that are not doing well.

Organise options

Make categories or ease people into choosing from more options.

Frame options

Present information to someone in a way choosing becomes easy.

Help people to understand their personal preferences

Helping them limit options to the ones that fit them.

Offer expert advice

This way, people can ask a specialist to help them choose, outsourcing the decision.

Limit or remove options

How far you should limit options depends on the behaviour you are designing. If you want someone to click on a button on your website, it is better to have one clear option. If you want someone to pick a health regimen, it works to have three options, with your preferred option positioned in the centre, as people tend to gravitate to the middle. If you want someone to buy a specific product, it works to show two options of which the left product (in Western countries) is a decoy that is priced much higher than your target product. This higher-priced product will act as a mental anchor that makes people feel your product is a perfect deal. These are best practices from behavioural science, but it is always a matter of experimenting with what works best in your situation. One thing remains the same for every situation: Less is always more when shaping decisions and behaviour.

Organise options

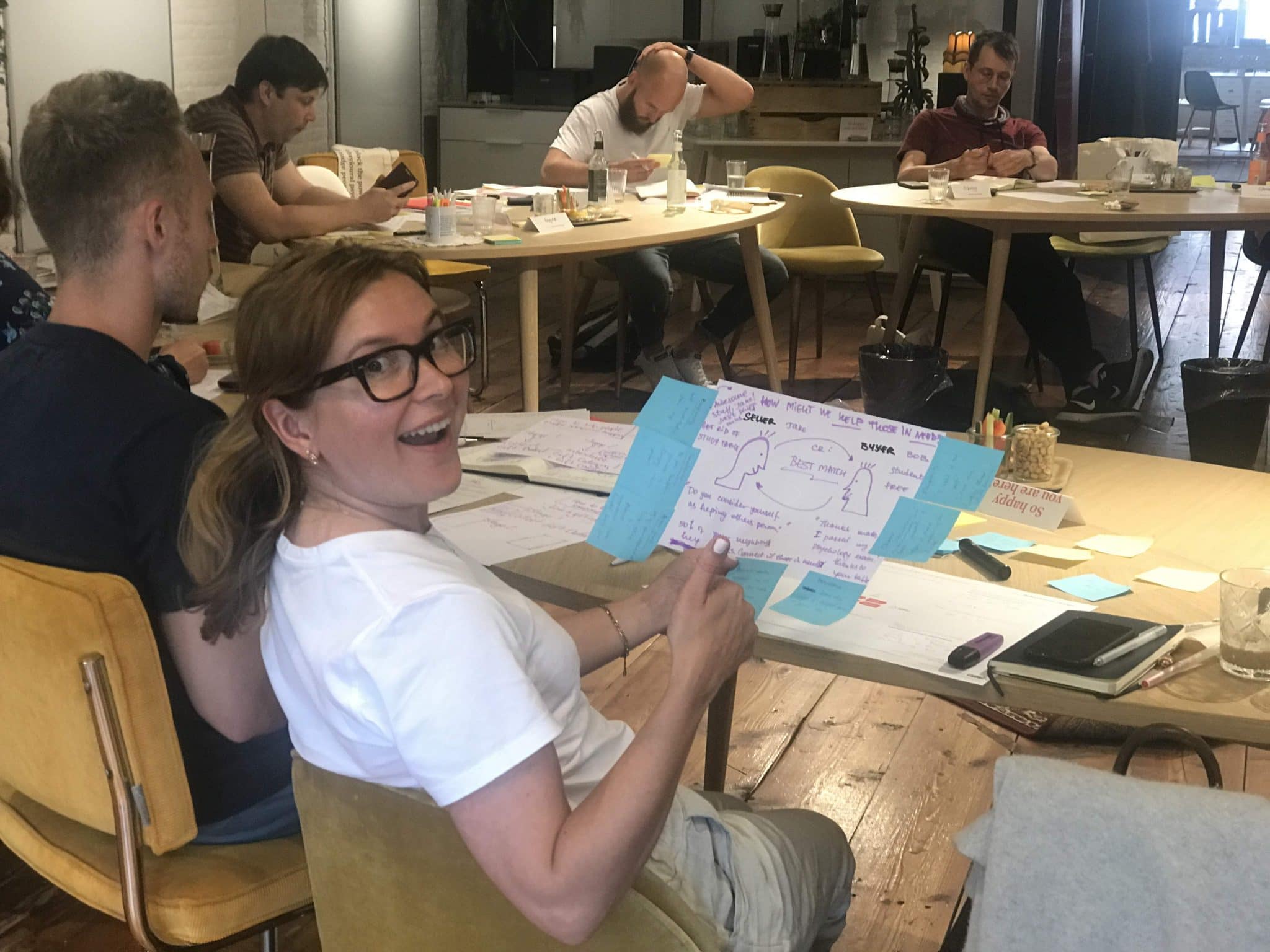

However, you can make people more capable of choosing from more options. You just have to do it gradually. A research team at a German car manufacturer ran an experiment with the manufacturer’s online car configurator. Potential clients using the configurator had to choose from 60 different options to configure their entire car. Every option again consisted of sub-options. For instance, to pick your car colour, you had 56 colours to choose from, picking your engine also four options and so on. It seemed logical to have people select an ‘easy option first. For example, colour is something that most people have a set preference for. And then move to the ‘harder’ options like the engine. The experiment made half of the customers go through the configurator from many options (e.g., colour) to fewer options (e.g., engine type). The other half from fewer options to many options. The researchers found that they ‘lost’ the second group: They kept hitting the default button or aborted the process. The first group hung in there. They had the same information and the same number of options, only the order in which the information was presented varied.

If you start someone off easy, you can teach them how to choose.

Frame Options

Sometimes option reduction is a matter of framing. In other words, thinking about how to present information to someone. Maybe you have kids, and well, most kids aren’t big on eating veggies. Mine isn’t, anyway. We, as parents, often tell our kids: ‘Eat your peas’. You’ll probably have more success if you give your kids a sense of control, designing the options a different way. ‘Do you want to eat your peas or carrots first?’ It can also work in our professional life. Let’s say you are in negotiation with a talent you like to attract your team or organisation. Make sure you frame your negations in a way options are limited but still allow for autonomy. To make it more real: Often, negotiations come down to challenging the salary offer. Suppose you give someone the option to get awarded a higher salary, but you tie a condition to it. For example, sure, you can have a higher salary X, but it implies X fewer days off. Your candidate still has freedom of choice, but at the same time, you framed your offer as bounded options. Thus, prevented setting the stage for a limitless salary/bonus battle, nitpicking over secondary employment conditions. ‘It’s either this or that kind of framing.

Identify personal preferences

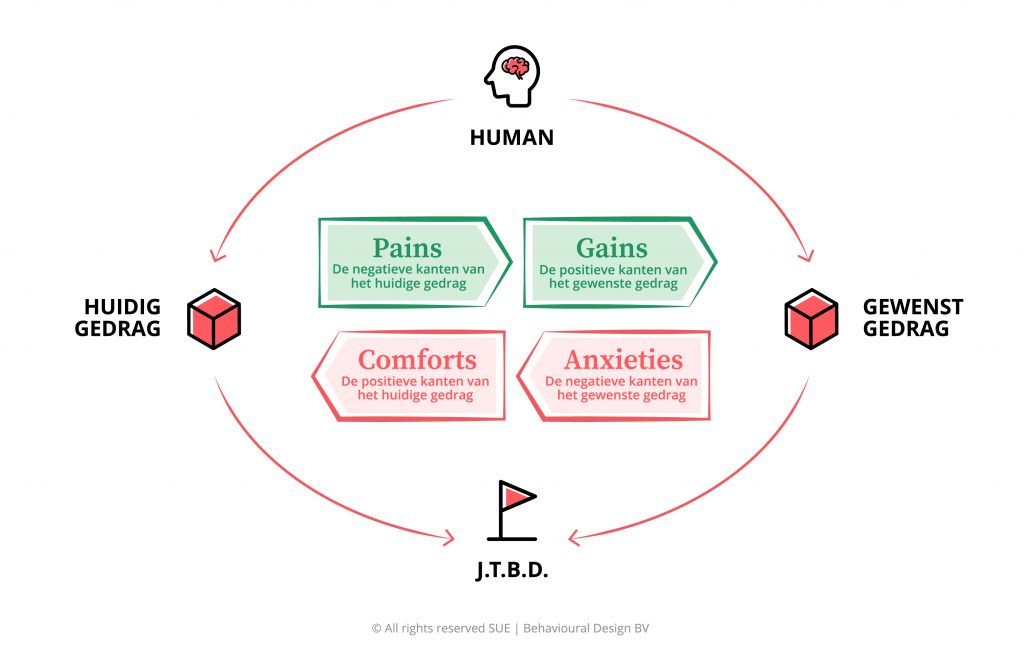

We have seen that when we experience option overload, we tend to rely on system 1 cues such as following the choices of others. If you can help someone identify their personal preferences, you can rule out a lot of options. This is why shopping bots or online filters really help us navigate through options. Once you have set your preference, you only get to see a selection of all available options.

Offer expert advice

A different way to reduce options is to outsource the decision process to an expert. In this case, we can learn from the healthcare domain. If you have a condition that can be solved with treatment A, B or C, most people follow their doctor’s advice for a specific treatment. He rules out some options for you. What if we could also provide trusted experts in other domains? If you know, you can rely on an exercise, nutrition, finance, education expert? That would save you a lot of option researching and go down a rabbit hole of endless possibilities. You could simply follow the lead of a trusted specialist.

The situation: we’re in the middle of The Big Quit

The situation: we’re in the middle of The Big Quit The situation: we’re in the middle of The Big Quit

The situation: we’re in the middle of The Big Quit

The Behavioural Insights

The Behavioural Insights

Challenge 1: Redesign Policy-Making and policy implementation.

Challenge 1: Redesign Policy-Making and policy implementation.

Mental accounting: How humans violate the economic theory

Mental accounting: How humans violate the economic theory

Mental accounting: The sunk cost effect

Mental accounting: The sunk cost effect Mental accounting: Using it for better decision-making

Mental accounting: Using it for better decision-making Suppose you want to learn more about how influence works. In that case, you might want to consider joining our

Suppose you want to learn more about how influence works. In that case, you might want to consider joining our

There is a cognitive bias related to this phenomenon called

There is a cognitive bias related to this phenomenon called