First and foremost, I wish you and your family a prosperous 2022, free of worries. We tend to wish each other happiness and luck in the new year. However, the effect of the absence of stress and anxiety – the other side of the happiness medal – will have a much more profound impact on your overall wellbeing.

One of the best ways to achieve a worry-free state of mind is not having to worry about whether you’d be able to take care of yourself and your loved ones. There’s strong scientific evidence that poor people tend to make things worse for themselves. They consistently make irrational and impulsive decisions because of the stress levels they experience.

So in this blog, I want to explore some of the key lessons from the world of behavioural finance on how to make better financial decisions, build up wealth and achieve financial peace of mind. I want to explore which simple behaviours and habits could profoundly impact your economic wellbeing.

Wealth and status signaling

Wealth and status signaling

It’s always interesting to start our search for insights by looking at the behaviour of “extreme users“. Extreme users are people on both ends of the spectrum: One exciting category is people with modest incomes who became financially independent at age 32. An opposite group of extreme users are the investment bankers, with huge salaries who personally went bankrupt only two months after losing their jobs.

There’s only a slight correlation between how much you earn and how wealthy you can become.

So what differentiates the wealthy people from the poor ones, even though many poor people look rich at first sight? A law in behavioural science called Parkinson’s Law describes the phenomenon that ‘expenses always tend to match income‘. No matter how much more revenue we get, we will start spending more and end up with precisely the same amount of money to set aside. Which, in the end, turns out to be way too little to support the lifestyle.

A big chunk of these increased expenses has to do with status signaling. We love to signal to others and ourselves that we’re climbing the social ladder. So we invest heavily in brands, hobbies, and the stuff that allow us to signal that status to others. Investment bankers during the financial crisis of 2008 – the self-proclaimed masters of the universe – went bankrupt in a matter of months because after losing their jobs, they realised that the private schools, the big house, and the two Maserati’s drained the little financial reserves they had.

Get more detailed information.

Download our Behavioural Design Sprint brochure telling you all about the ins and outs of the sprint in detail. Please feel free to contact us suppose you would like some more information. We gladly tell you all about the possibilities.

Being rich is not the same as being wealthy.

One of Morgan Housel’s pearls of wisdom in the book “The Psychology of Money” is that the difference between being rich and being wealthy is that you don’t see wealth. Rich people drive expensive cars. Wealthy people have put that money in investment funds, so the money starts working for themselves.

One of the fascinating communities on the internet is the FIRE movement. FIRE stands for Financially Independent / Retire Early. They apply a geek and hacker mindset to create financial independence for themselves. One of the fascinating people in this community is Mr Moneymoustache, a Canadian guy who retired at 30. He lives off the interests of his financial decisions and lives a pretty wealthy lifestyle. Check out the video below to listen to his story.

Five behaviours that differentiate wealthy people from others.

1. Spend less on stuff.

“Spend less on stuff” might sound trivial, but the number one behaviour that leads to financial independence is to take the money you spend on stuff you don’t need – and that doesn’t make you happy – on stuff that makes money for you, like stocks, bonds, a business or a house you can rent out. Once you understand the dynamics of status signalling and how much of your income you waste on stuff that has no other purpose than to signal your prosperity, you’d be surprised how much more you will end up saving at the end of the month.

It reminds me of the brilliant quote that is attributed to many different people:

“We buy things you don’t need, with money we don’t have, to impress people we don’t like.”

Owning stuff doesn’t make you happy. The direct route to serotonin, the gateway hormone for wellbeing and happiness, is the feeling of achievement and self-importance you gain from learning, creating and mastering things. We wrote about this in a previous blog.

2. Don’t try to beat the market. Instead, follow the market. Invest in index funds

Morgan Housel refers to a fascinating study in his book. About 85% of all professional stockbrokers didn’t beat the market over a decade ending in 2019. Let this sink in for a moment. We trust our money to people we pay hefty fees that have no better qualities in predicting the market than dart-throwing monkeys.

Warren Buffett, the most successful investor on the planet, recently said that he would put all his money in Index Funds if he did it again. These funds spread their money in the 500 best-performing companies on the stock exchange. If you do this, you will always win.

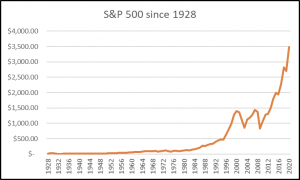

The enormous psychological trick is to resist selling in a panic when the stock exchange is performing poorly or when a bubble bursts and a crisis occurs. If you zoom in on today versus yesterday, your money will sometimes take a blow. However, if you zoom out over decades, the stock exchange follows a spectacular growth curve.

BONUS: free ebook 'Mental Accounting: How Money Works in our Mind''

Especially for you we've created a free eBook 'Mental Accounting: How Money Works in our Mind'. For you to keep at hand, so you can start using the insights from this blog post whenever you want—it is a little gift from us to you.

![]() 3. They understand compound interest.

3. They understand compound interest.

Albert Einstein once called compound interest the Eighth Wonder of the World. It’s pretty hard for people to understand the magic of compound interest. Still, the simple idea is that if you wait long enough, the accumulated interest on your interest grows exponentially. If you put 100 dollars per month on your investment account at an average of 5% interest and do this for five years, you will have invested 6000 dollars, but the compound interest would be 7573 dollars on top of that 6000 dollars.

That’s why having money in your savings account is such a terrible idea. Inflation decreases the value of that money over time, while low-interest rates don’t get the compounding effects to kick in. The most intelligent strategy is to maintain a savings account for unnecessary expenses and put everything you don’t need today in a long term investment fund.

![]()

4. They understand the power of default options.

Most people – like me – hate to think about money or get to deal with cash. Smart people set rules that would directly transfer the money they have left at the end of the month into their investment fund. This way, they don’t need to spend the mental energy to do the right thing. If the money’s there, it will be invested. If you had spent more money on other things, your investment contribution would be lower for a month.

![]()

5. They are hyper-rational in times of stress.

Being hyper-rational means, you will have to learn to get comfortable with loss. Morgan Housel from ‘The Psychology of Money” wrote:

The S&P 500 increased 119-fold in the 50 years ending 2018. All you had to do was sit back and let your money compound. But of course, successful investing looks easy when you’re not the one doing it.

“Hold stocks for the long run,” you’ll hear. It’s good advice. But do you know how hard it is to maintain a long-term outlook when stocks are collapsing? Like everything else worthwhile, successful investing demands a price. But its currency is not dollars and cents. It’s volatility, doubt, uncertainty, and regret – all of which are easy to overlook until you’re dealing with them in real-time.

The market is performing lower than a previous all-time high peak most of the time. In that period, you are losing money. But if you wait long enough, you will have outlived enough market peaks to make a great return. All you need to do is to keep your nerves and stay patient.

One of the worst ideas is to look at the performance daily through all these new apps. They will make you nervous, and you’ll be inclined to act and make terrible financial decisions.

How do you do. Our name is SUE.

Do you want to learn more?

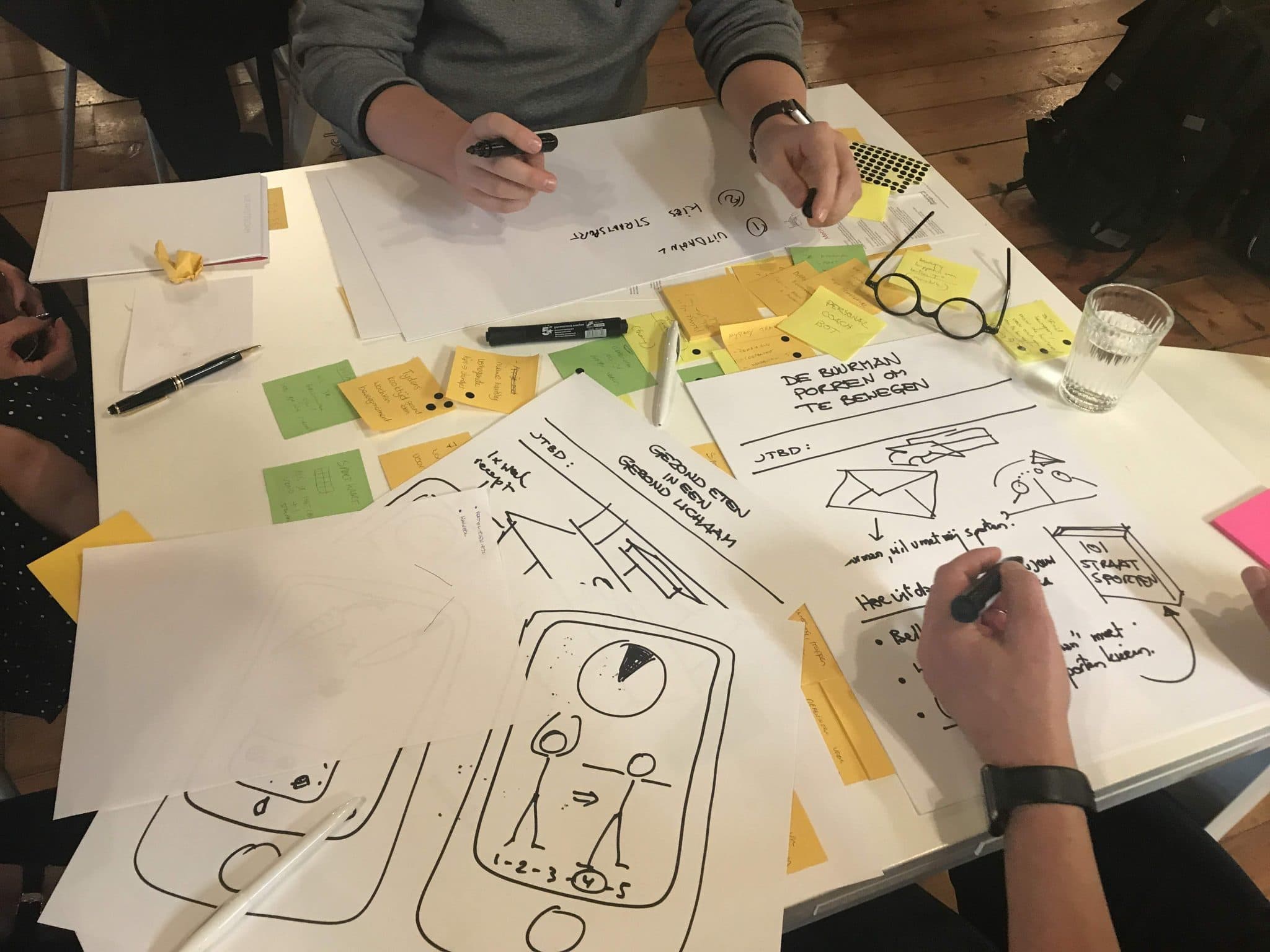

Suppose you want to learn more about how influence works. In that case, you might want to consider joining our Behavioural Design Academy, our officially accredited educational institution that already trained 2500+ people from 45+ countries in applied Behavioural Design. Or book an in-company training or one-day workshop for your team. In our top-notch training, we teach the Behavioural Design Method© and the Influence Framework©. Two powerful tools to make behavioural change happen in practice.

You can also hire SUE to help you to bring an innovative perspective on your product, service, policy or marketing. In a Behavioural Design Sprint, we help you shape choice and desired behaviours using a mix of behavioural psychology and creativity.

You can download the Behavioural Design Fundamentals Course brochure, contact us here or subscribe to our Behavioural Design Digest. This is our weekly newsletter in which we deconstruct how influence works in work, life and society.

Or maybe, you’re just curious about SUE | Behavioural Design. Here’s where you can read our backstory.