In this blogpost I want to explore three organizational hurdles that that prevent innovation from happening.

Before we delve into the three hurdles, we need to establish what defines successful innovation. I think the best definition is that it’s about solving customer problems in new and better ways.

In my opinion, customer-centric innovation is, therefore, a pleonasm. It doesn’t make sense to innovate if it isn’t about solving a customer problem more smartly or cheaply. But when it comes to finding the right problems to solve and solving them right, every innovator has to deal with the following three hurdles:

Hurdle 1: We’re too much in love with our solution

We usually have no clue about what our customer needs. However, we have many assumptions. Most of them are simple projections of our prejudices and beliefs. Furthermore, we often are highly motivated to convince ourselves that the problem of our customers is precisely the problem that our solution solves. Customer-centric innovation, therefore, is often thought of as “the problem of the customer is that he/she hasn’t figured out yet how awesome our product is”.

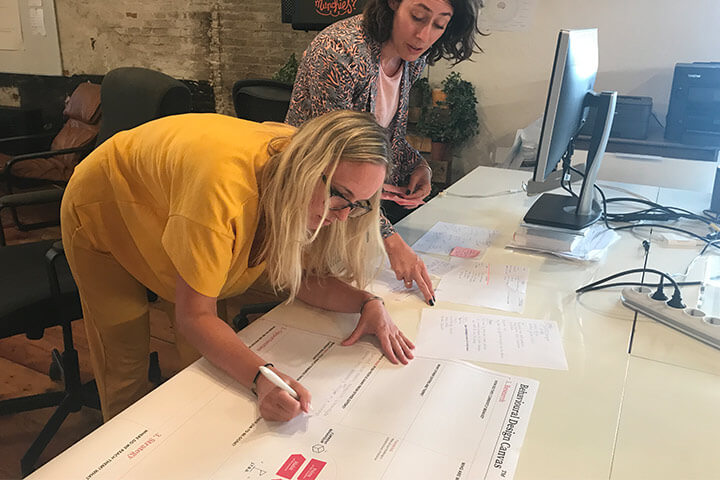

We do this ‘thinking backwards’ from our solution all the time. We can’t help ourselves. And I think this is one of the most challenging habits to overcome. In a Behavioural Design Project, we always start by warning everyone in the project that it will pay off to avoid getting to solutions too fast. Instead, we always insist on taking enough time to fall in love with the problem.

A client of ours gave beautiful feedback last week on this. She said:

“When listening to your interviews, I was getting increasingly impatient about when you would finally start asking questions about our solutions. And you only spend the last 15% of the interview on this. But suddenly, it all made sense because we now understand that our solution is not properly solving the right problem”.

Hurdle 2: Insight paralysis. What’s the killer insight?

Quite often, market research is boring and paralyzing. The more insights you get, the more you get paralyzed about what to do with them.

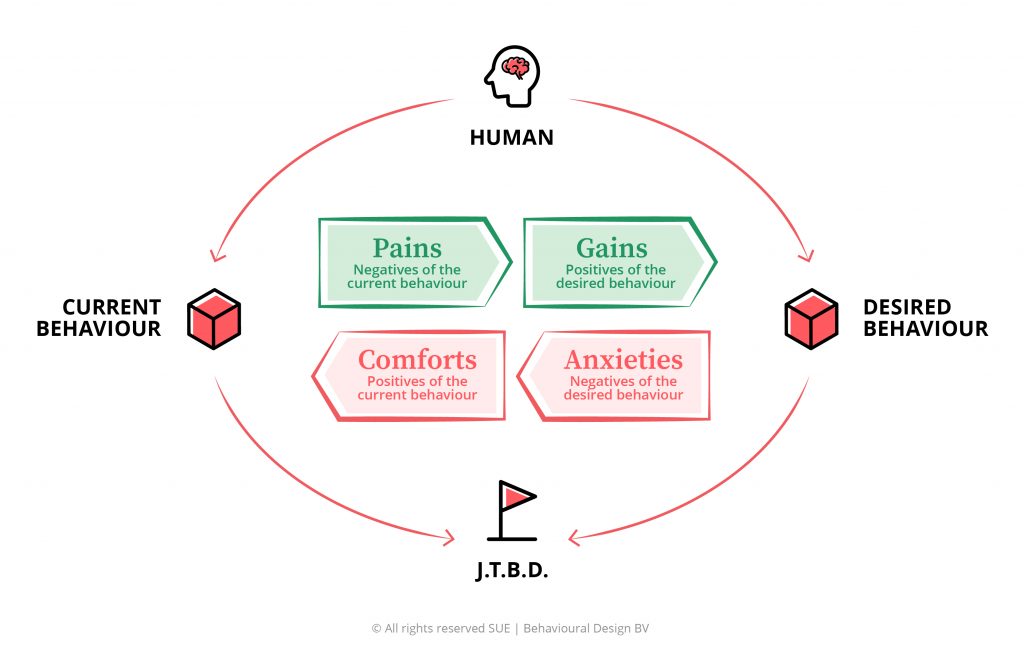

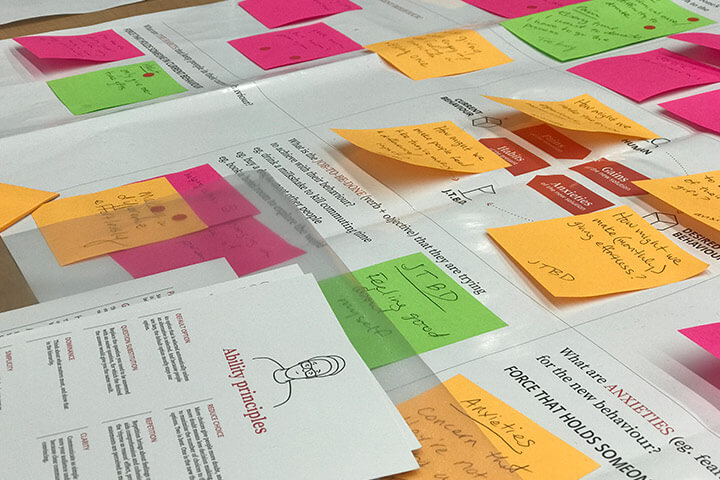

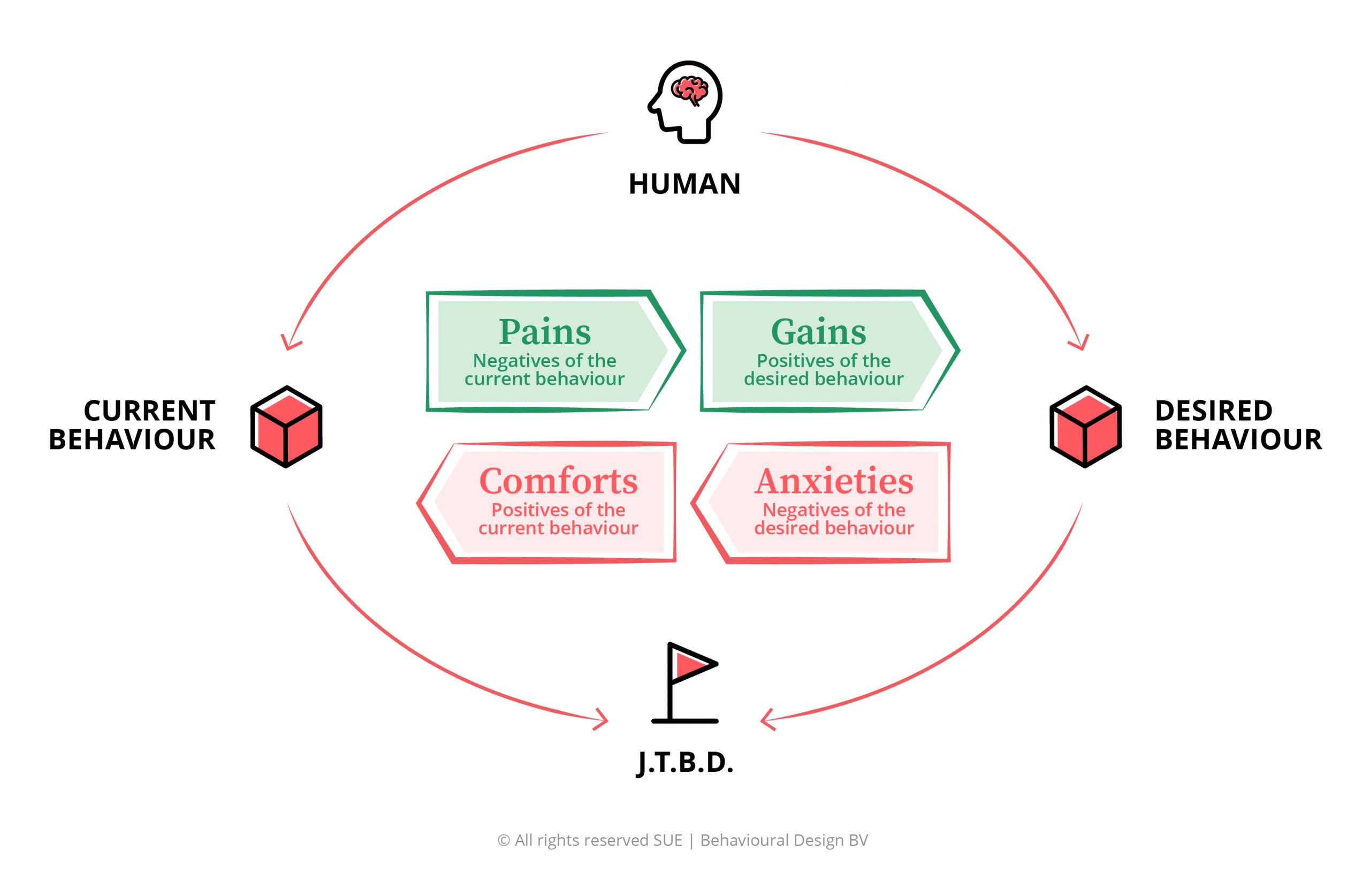

In a Behavioural Design Sprint, insight gathering is never a goal in itself. Instead, we treat them as an intermediate step for spotting opportunities. Behavioural Designers neatly map insights as forces that could boost or hinder behavioural change from happening. But more importantly: We don’t present insights; instead, we present opportunities.

Nothing is more powerful and inspiring than an insight translated into an opportunity. For instance, after interviewing blue-collar workers in an environment where there was a problem with social safety, we turned our understanding of the problem in the following briefing:

How might we help blue-collar workers at Company X address bullying as a behaviour that contributes to a pleasant working environment by taking away the anxieties that they could feel embarrassed as overreacting, turn colleagues into offenders, or feel like a snitch?

Hurdle 3: Stakeholders treat every change as a risk

Every time you want people in organizations to say yes to something new, you have to understand that you’re asking them to take a gamble. Doing something new is always a risk. And the bigger the organization, the less appetite for risk.

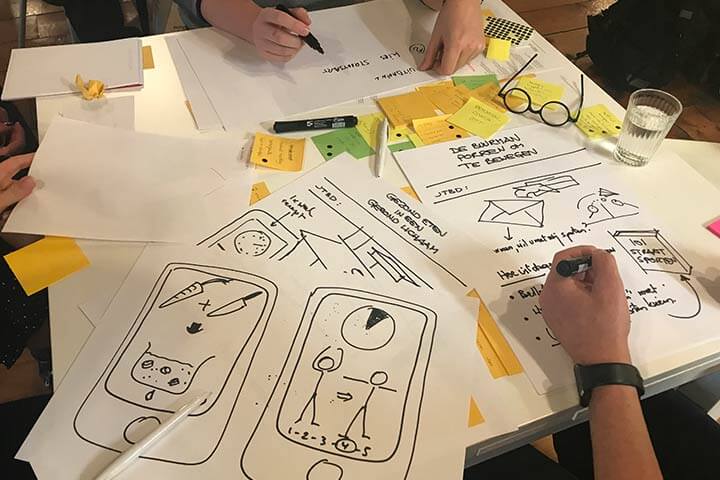

The interesting question is: How can you make people feel comfortable and remove their anxiety about the new solution? The answer is prototyping. Time and again, we learn in our Behavioural Design Sprints that prototyping and testing solutions with the end user not only provides you with a deeper understanding of what works and what doesn’t but, more importantly, it has a profound effect on persuading and convincing internal stakeholders to feel much more comfortable to say yes to the implementation phase.

In the last couple of months, I have learned to appreciate more and more that the actual value of running Behavioural Design Sprints is as much about giving creative and strategic confidence to do new things as it is about exploring and validating new ideas with the end user.

4. Expert biases, groupthink and cherry-picking the insights that match our beliefs

4. Expert biases, groupthink and cherry-picking the insights that match our beliefs

Hope is a powerful tool in elections

Hope is a powerful tool in elections Companies are selling hope

Companies are selling hope

Science as a process, behaviour as an outcome

Science as a process, behaviour as an outcome

Challenge 1: Redesign Policy-Making and policy implementation.

Challenge 1: Redesign Policy-Making and policy implementation.