We often get questions on the difference between Behavioural Design and Growth Hacking. The short answer is that Behavioural Design is a method to come up with insights and ideas, while Growth Hacking is a process of rapid experimentation across digital marketing channels. Whereas Growth Hacking can provide you with the tactics, Behavioural Design provides you with the ideas and strategies to make the tactics work. Let’s explore this core idea a bit deeper.

Behavioural design is about seduction and persuasion, while Growth Hacking is about conversion.

A couple of years ago, I attended a fascinating conference in Estonia called Digital Elite Camp. It was probably one of the most exciting conferences I have ever attended (ok maybe except for our Behavioural Design Fest). The conference brought together digital marketers from all over the world to get inspired by growth hacking. I loved every second of it. I immediately sensed that I was looking at the avant-garde in marketing.

Geeks were geeking out on landing page optimisation, e-mail performance, search ranking, conversion rate optimization, etc. Everyone was obsessed with A/B testing and with building, measuring and learning. You could sense the joy of the desire to overthrow old school thinking on marketing, advertising and sales. This was where the future was happening.

Except for one thing.

I still vividly remember the crappy landing page design, the triviality of the incremental changes and the cheapness of the sales triggers with which they experimented. I felt that, although it looks incredibly cool to figure out how to get a conversion funnel right, it was too much conversion tactics and too little understanding of persuasion and seduction. They got lost in tools and tactics, while they didn’t care too much for how the bits and bolt of how seduction work.

Imagine what would happen if you would hand over the problem of seducing a girl to a computer scientist. His approach would make a lot of sense from a logical point of view, but chances that you’ll end up with a smack in the face are pretty high.

Imagine what would happen if you would hand over the problem of seducing a girl to a computer scientist. His approach would make a lot of sense from a logical point of view, but chances that you’ll end up with a smack in the face are pretty high.

Behavioural Design is about understanding how to create magic with the Growth Hackers toolbox

What I love about growth hacking is that it brought a bit of creativity to digital marketing. The problem with digital marketing is that to do it properly, you need to get a lot of things right. It’s not enough to know how to find audiences if you don’t know how to attract them. It’s not enough to attract if you don’t know how to convert them into qualified leads. It’s not enough to have qualified leads if you don’t know how to nurture them into trying out your products and services. And it’s not enough to sell to a customer if you don’t know how to turn them into excited, happy regular users.

Growth hackers looks at all these requirements in a more holistic way and try to figure out how to connect them in such a way that the tactics that are deployed actually lead to business growth.

But learning ‘growth hacking’ is a bit like learning Photoshop. I can teach you all the tools and techniques to start working with Photoshop, but if you have no clue on how composition, perspective and aesthetic works, you’ll use the tools to create shit.

With the right tools and tactics, you can optimize for a local, but not for a global maximum. And the missing clue in growth hacking is insight in the human psychology of decision making. If you don’t understand how people make decision and why they do things or don’t do things, your growth hacking tactics are not going to to trigger the customer or user behaviour needed for growth.

If you don’t understand how people make decisions and why they do things or don’t do things, your growth hacking tactics are not going to trigger the customer or user behaviour needed for growth.

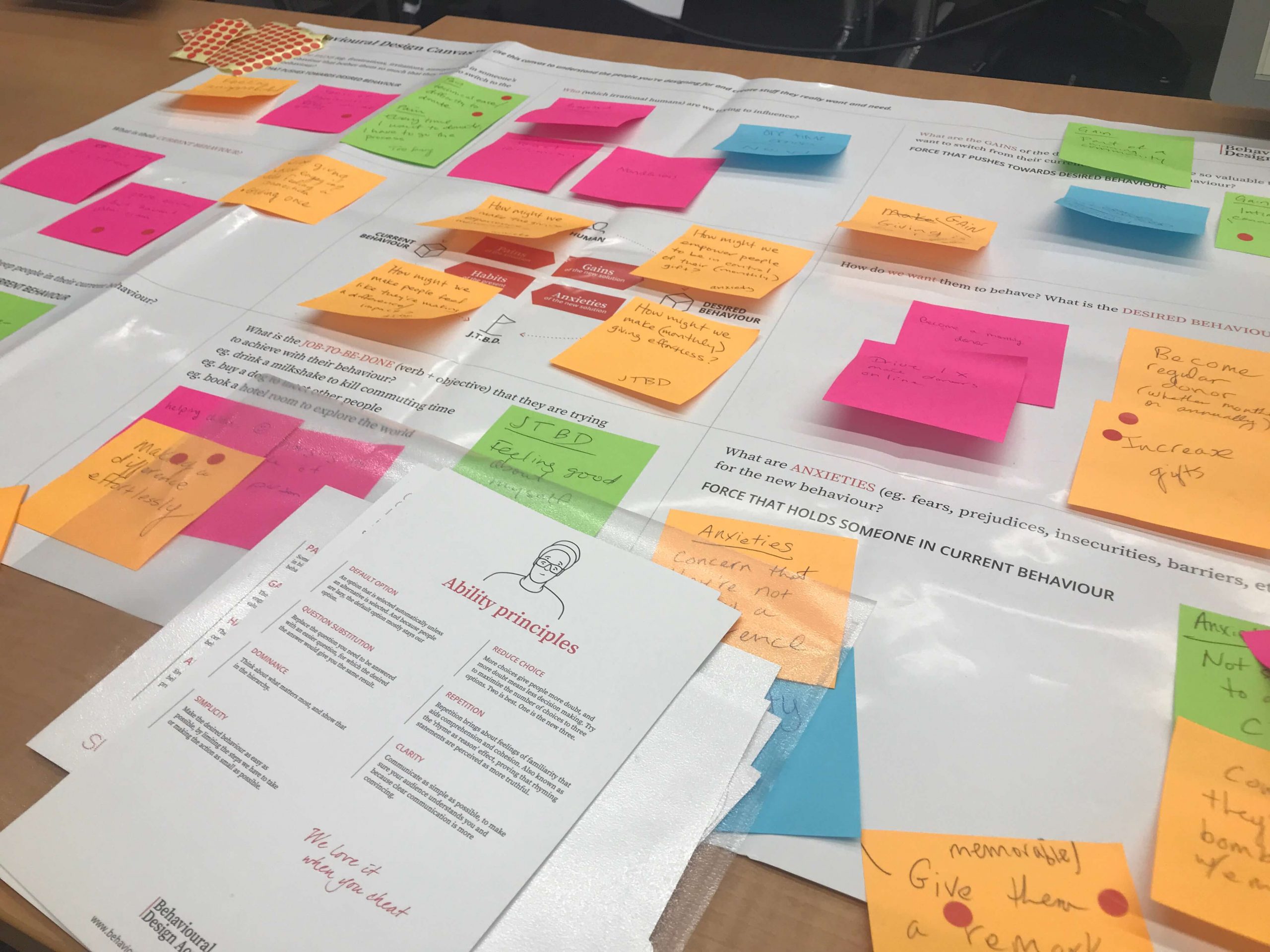

The Behavioural Design Method helps you to find radical new ways to connect with a user motivation or goal. It helps you to understand which barriers you need to address, how to make the desired outcome easy, how to add some motivational boosters to the mix and how to communicate the right series of triggers at the right time and place.

Case: Convert people for a Debt Relief Programme

Let me give you an example. In a project we did for an NGO that helps people to get into a free Debt Relief Programme, we discovered that the only way to break through people’s resistance and to turn audiences into leads, was to connect with them in three steps:

- Establish trust by connecting with their pain and frustrations

- Reduce uncertainty by claiming that all counsellors have been in debt too and know how you feel

- Motivate action by making it OK to have a get-to-know each other conversation first to see if it could work

Every other way of pitching the service was doomed to fail because people didn’t want to be framed as people who need help. Imagine a growth hacker optimising both the website and the digital campaign, not knowing this crucial insight. He would optimize within the boundaries of a useless strategy.

Want to learn how to apply behavioural science in practice?

We have created a brochure that explains all the ins and outs of the Fundamentals Course. From the program to the former participants. From the investment to the people behind the Academy: it's all in there.

Short Summary: Behavioural Design versus Growth Hacking

- What behavioural designers and growth hackers have in common is a methodology of creative experimentation to figure out what works and what doesn’t

- Whereas Growth Hacking is about the tactics and the tools, Behavioural Design is about how to create meaning and magic with the tools

- Behavioural Design is a method, and Growth Hacking is a process. It’s not because you have a process, that you know what you’re doing

- Behavioural designers and growth hackers should have sex because they will make beautiful babies.

One more thing: Don’t call yourself a growth hacker (or a behavioural designer)

Growth hackers are first and foremost digital marketers. They use the creative method of growth hacking to come up with smarter ideas for digital marketing faster. A Growth Hacker without technical digital marketing skills is worthless. The same goes for Behavioural Design.

I’m not convinced we should call ourselves Behavioural Designers. We are product-, marketing-, sales- or UX-professionals who use the Behavioural Design Method to come up with better products, services, communication and policies. I think that’s a better way to put it. We have also created a post on the difference between Behavioural Design and Design Thinking.

BONUS: free cheat card Value Perception

This cheat card will show you how we (unconsiously) value objects and people. It is a helpful tool if you want to hack your growth and power it up with Behavioural Design. For you to download, and use right away—a little gift from us to you.

How do you do. Our name is SUE.

Do you want to learn more?

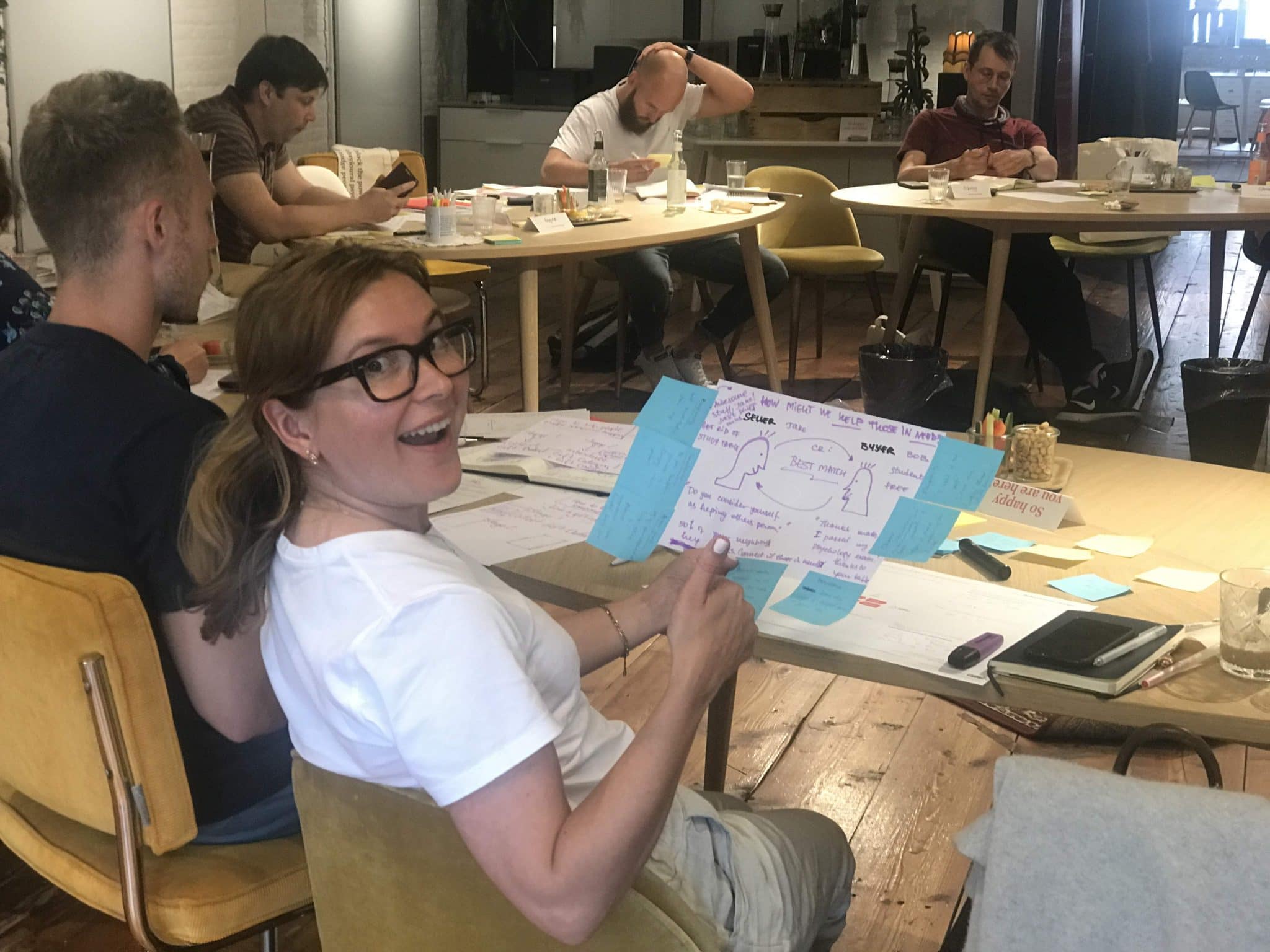

Suppose you want to learn more about how influence works. In that case, you might want to consider joining our Behavioural Design Academy, our officially accredited educational institution that already trained 2500+ people from 45+ countries in applied Behavioural Design. Or book an in-company training or one-day workshop for your team. In our top-notch training, we teach the Behavioural Design Method© and the Influence Framework©. Two powerful tools to make behavioural change happen in practice.

You can also hire SUE to help you to bring an innovative perspective on your product, service, policy or marketing. In a Behavioural Design Sprint, we help you shape choice and desired behaviours using a mix of behavioural psychology and creativity.

You can download the Behavioural Design Fundamentals Course brochure, contact us here or subscribe to our Behavioural Design Digest. This is our weekly newsletter in which we deconstruct how influence works in work, life and society.

Or maybe, you’re just curious about SUE | Behavioural Design. Here’s where you can read our backstory.