It’s my conviction that one has to practice what one preaches. That’s why, twice a year, we run a Behavioural Design Sprint on ourselves, to learn what our customers need and how we can get better at helping them to achieve success.

Turn customer insights into improvements

I love to share the lessons we learned. The Behavioural Design Sprint we did on ourselves is an excellent illustration of how outside-in thinking helped us turn our understanding of our customers into a dramatic improvement of our offering.

In the brief case study below, I will walk you through the key psychological insights, and how these insights inspired us to re-designed our processes to serve our customer’s needs better.

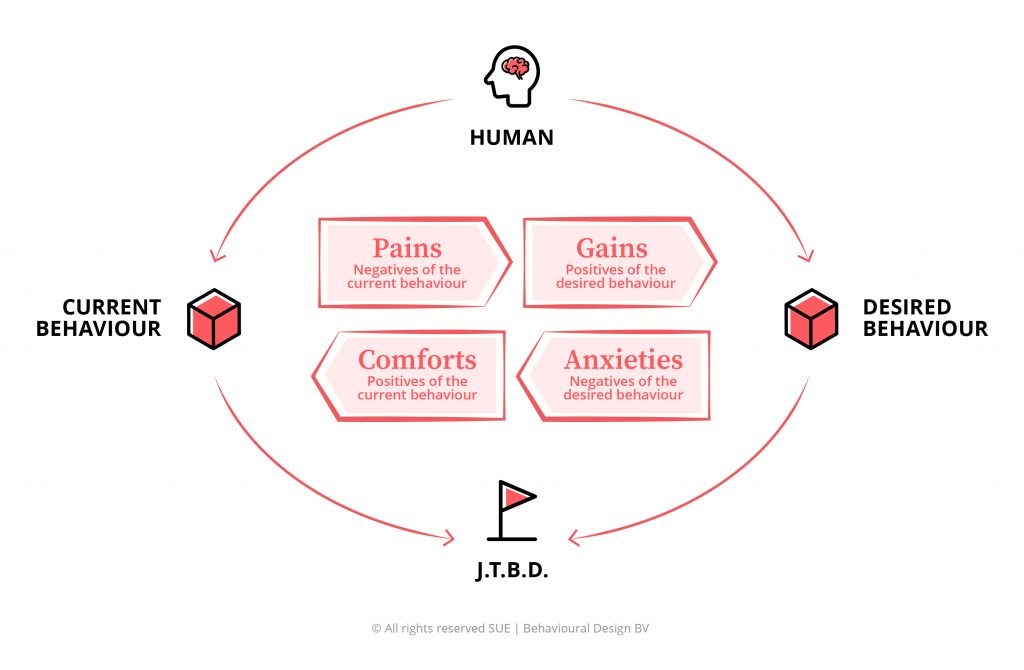

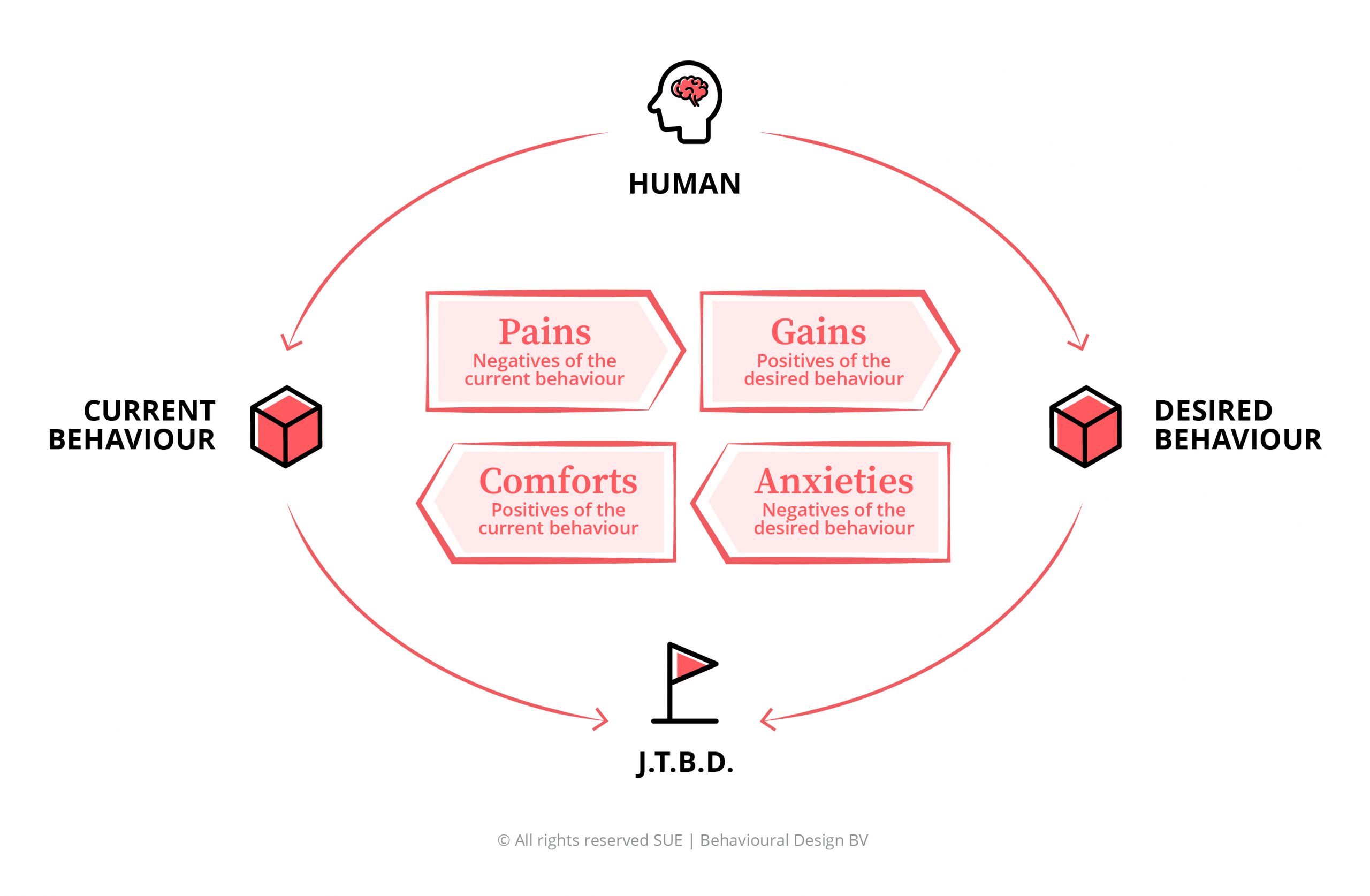

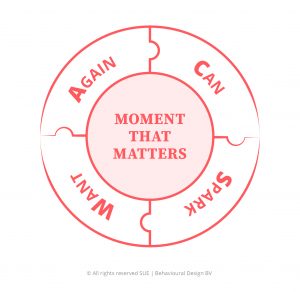

I will use the SUE | Influence Framework terminology to describe the most significant insights into how our customers think, feel, and behave. You can learn everything about the framework in the article “The SUE Influence Framework Explained“.

The Behavioural Insights

The Behavioural Insights

Pains

The most significant Pains that drive their search for help is that our clients:

1. Often lack actionable insights into what their audience really needs and how they think and feel.

2. Often lack time and confidence to do qualitative in-depth interviews with their customers or prospects.

3. Often feel frustrated that part of the strategy gets lost in the implementation phase.

4. Often get stuck in execution, because they miss support, coaching and expert reviewing

Comforts

The third component of our Influence Framework are ‘Comforts’. These are the psychological forces that prevent our clients from seeking outside help. The most significant comfort is that teams have their own processes, deadlines and methods. It’s often difficult to overrule these processes. Yet, external partners like ourselves, often impose our own way of working.

Anxiety

The most significant Anxiety that prevent them from working with SUE more often is that a team doesn’t have the capacity or time for a full Behavioural Design Sprint. Sometimes they just need Behavioural Intelligence on board at the right time. In those instances, their own process and timing needs to be leading.

Want to do a Sprint with us?.

Download our Behavioural Design Sprint brochure telling you all about the ins and outs of the sprint in detail. Please feel free to contact us suppose you would like some more information. We gladly tell you all about the possibilities.

The opportunity

Based on the insights I described above, we realized we had to update our offering for the first time in 10 years. The new offering needs to provide a better answer the following behavioural opportunities:

- Piggy-bag on Comforts: How can we provide behavioural design value without interfering with our clients processes?

- Take away Anxieties: How can we lower the barrier to hire Behavioural Design Expertise? How can we provide value without deep effort or time investment from our client and their team?

- Solve Pains: How can we help our clients with understanding their customers, prototyping, testing their ideas, and add the magic layer of behavioural science onto their communication and marketing?

- Experience Gains: How can we get our clients to experience breakthroughs and success as quick as possible?

- Achieve Jobs-to-be-Done: How can we assist our clients into translating a deep understanding of their target audience into fast and clear improvements of their products, services, marketing, or policies?

The Key Behavioural Insight is that we learned that we needed to find ways to provide behavioural intelligence and value inside our customer’s projects and their way of working.

The perfect time to learn about influence

With the economy sliding into a recession, understanding your customers will be essential to navigate through the turbulence. Join our Fundamentals Course to learn a practical method to achieve this!

The solution

We came up with four simple new products. All of them aim to leverage Behavioural Design at the right time, at the right place inside the processes of our customers:

- Behavioural Insights: Get a SUE Behavioural Design Expert to conduct in-depth interviews with your customers, prospects, or employees. Get the best interviewers to find the killer psychological insights into how your market things, feels and behaves. Get help when needed, or get monthly Behavioural insights updates on threats, opportunities, and low hanging fruit on what your customer needs and how you can help them

- Behavioural Design Scan: Get a SUE Behavioural Design expert do a scan of your customer journey, communication, and competitors and get a hands-on-advice on how to make your communication much more compelling and persuasive

- Prototype and test and refine your strategy: Get a SUE Behavioural Design expert to prototype, test and validate your strategy, campaigns, and innovations, and learn fast what works and how to get people excited.

- Successful Implementation: Get a SUE Behavioural Design Expert to optimize and supercharge your marketing communication, using behavioural science as their tool.

Conclusion: Design for the problem

If we hadn’t done our interviews with our customers, we would never have understood that the biggest opportunity for SUE was to find a way to lower the barrier for getting Behavioural Design expertise. Understanding that the biggest barrier is that our customers have internal processes that can’t be overruled easily, was the key to rethinking how we can provide value without interfering with these processes.

We’re constantly learning, improving, and adapting, and we still have a long journey ahead of us. But I’m convinced it’s going to be a fun journey.

How do you do. Our name is SUE.

Do you want to learn more?

Suppose you want to learn more about how influence works. In that case, you might want to consider joining our Behavioural Design Academy, our officially accredited educational institution that already trained 2500+ people from 45+ countries in applied Behavioural Design. Or book an in-company training or one-day workshop for your team. In our top-notch training, we teach the Behavioural Design Method© and the Influence Framework©. Two powerful tools to make behavioural change happen in practice.

You can also hire SUE to help you to bring an innovative perspective on your product, service, policy or marketing. In a Behavioural Design Sprint, we help you shape choice and desired behaviours using a mix of behavioural psychology and creativity.

You can download the Behavioural Design Fundamentals Course brochure, contact us here or subscribe to our Behavioural Design Digest. This is our weekly newsletter in which we deconstruct how influence works in work, life and society.

Or maybe, you’re just curious about SUE | Behavioural Design. Here’s where you can read our backstory.

The Behavioural Insights

The Behavioural Insights

Challenge 1: Redesign Policy-Making and policy implementation.

Challenge 1: Redesign Policy-Making and policy implementation.

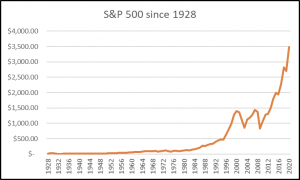

Mental accounting: How humans violate the economic theory

Mental accounting: How humans violate the economic theory

Mental accounting: The sunk cost effect

Mental accounting: The sunk cost effect Mental accounting: Using it for better decision-making

Mental accounting: Using it for better decision-making

Suppose you want to learn more about how influence works. In that case, you might want to consider joining our

Suppose you want to learn more about how influence works. In that case, you might want to consider joining our